FCMB Reactivation of Account Form Corporate free printable template

Show details

May 13, 2011 ... company of First City Group, and maintains a presence ... 161 Forms: Account opening form. Dividend ... particularly in Africa, are trends for which CMB, wit hits focus ...... Our

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign how can i reactivate my on process request to reactivate form

Edit your fcmb ussd code form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fcmb transfer code form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how can i reactivate my fcmb account on process request to reactivate online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ussd for fcmb bank form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fcmb transfer code 2025 form

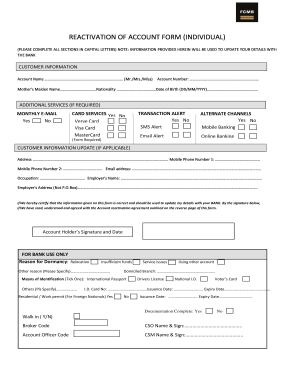

How to fill out FCMB Reactivation of Account Form (Corporate)

01

Obtain the FCMB Reactivation of Account Form (Corporate) from an FCMB branch or download it from the FCMB website.

02

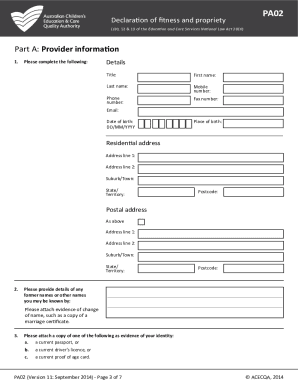

Fill in the corporate details such as the company name, registration number, and date of incorporation.

03

Provide the contact information of the authorized signatories, including names, positions, and contact numbers.

04

Complete the section regarding the reason for reactivation and any relevant account information.

05

Attach any required documents, such as proof of identity for signatories, company registration documents, and previous account statements.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form and required documents to the nearest FCMB branch or via the designated submission method.

Who needs FCMB Reactivation of Account Form (Corporate)?

01

Corporations or businesses that have had their accounts with FCMB inactive and wish to reactivate them.

02

Authorized signatories of the corporate account who need to access banking services again.

03

Companies needing to maintain their financial activities after a period of inactivity.

Fill

ussd code for fcmb bank

: Try Risk Free

People Also Ask about transfer code for fcmb

How do I recover my FCMB account?

Dial *329*0# Select Create/Reset code. Select your ATM Card (for customers with multiple cards) Enter your ATM Card PIN.For Dispute Resolution, see steps below: Dial *329# on your mobile phone. Select Self-Services from the menu. Select Dispute Resolution, then proceed to choose your account.

How do I unblock my USSD code for Access Bank?

Code to unlock access bank account Having blocked your account, you will not be able to unblock it by yourself thereafter with a code. Kindly visit the nearest Access bank branch to get your account unblocked.

How can I reset my USSD FCMB code?

Simply dial *329*0#. #FCMB #MyBankAndI | Facebook.

Can I reactivate my FCMB account online?

How can I reactivate my FCMB account? Log on to FCMBOnline personal version and click on the Utilities menu. Select FCMBOnline Mobile . Click on Process Request to reactivate.

How long does it take to unblock a bank account?

It can take 2 weeks or even more in some cases. First, you must consider that banks involved in this process are acting in different time zones, which could cause delays depending on when they get the initial transfer information.

How do I reactivate my USSD access bank code?

Simply dial *901*AMOUNT*NUBAN Account Number# (e.g: *901*1000*1234512345#) from your phone number. Authenticate using a four (4) digit security code. You can create a security code using the Menu option. Dial *901*AMOUNT*NUBAN Account Number# (e.g *901*1000*1234512345#) from your phone.

How do I register for USSD code?

Reach out to your provider (MNO or third-party gateway) to request a USSD code allocation. You might be asked to provide a business plan alongside other documentation. Decide what kind of code you'll be using based on your budget and other considerations.

How do I activate my FCMB dormant account?

Terms and Conditions A valid email or phone number is required. Bank Verification Number (BVN) is required. A credit inflow to account in the first month of reactivation allows you to enjoy the benefits. Sign up for at least one (1) of the electronic banking channels.

How can I unblock my Bank Account?

What to do it if is blocked? Contact your bank and find out. It can be a quick and easy process. Access your online banking and check if there have been any payments made or received out of the ordinary. Open a new bank account.

How do I activate my transfer code?

Another option to change/activate you new transfer PIN code is to dial *600*Default PIN*New PIN* and send this message. For example, dial *600*0000*1234*1234# and then send/ok. We hope this information was useful for you and explanatory enough. You can check some of our other articles for learning about other services.

How do I register my FCMB USSD code?

How to activate the FCMB USSD Dial *389*214# from a registered phone number linked to your FCMB account. Kindly choose the second option “Activate with account.” In the next slide, enter your account number. Subsequently you'll receive a message indicating that you've successfully synchronized .

How can I reactivate my FCMB USSD code?

If you have not created your transaction code, simply follow these simple steps: Dial *329*0# Select Create/Reset code. Select your ATM Card (for customers with multiple cards) Enter your ATM Card PIN. Create a 4-digit Transaction Code e.g. 1234. Enter your USSD PIN. Transaction code created successfully.

How do I unblock my USSD code access bank?

Having blocked your account, you will not be able to unblock it by yourself thereafter with a code. Kindly visit the nearest Access bank branch to get your account unblocked.

How do I open my USSD code online access?

What is the code to open Access bank account? How to do this? You can open an access bank account with the USSD code *901#, this code can be used for opening an access bank account, buying airtime, transferring funds to other accounts, bill payments, generate OTP, cardless withdrawal etc.

How can I get my bank account unblock?

If you need to “unlock” your account, you'll need to contact your bank as soon as possible. If your account has been locked because of a security issue, you might find the only way to do this is by phoning your bank's emergency assistance or help line.

How can I activate FCMB mobile transfer code?

The official FCMB code for transfer is *329#, with this code, you can make use of the FCMB mobile transfer code to other banks. It serves as your FCMB transfer pin and FCMB shortcode. With this, you can also buy airtime and do many other tasks.

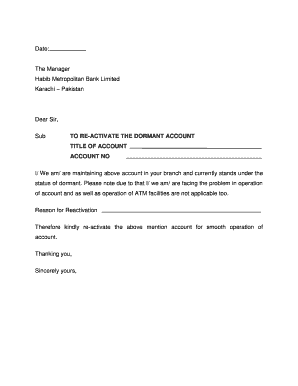

Can I reactivate my bank account online?

Reactivating your bank account You must submit a written application to the bank. For joint accounts, signatures of all accountholders will be needed, irrespective of a single or joint operating mode. You will have to submit your KYC (Know Your Customer) documents.

How do I reactivate my FCMB account?

Terms and Conditions A valid email or phone number is required. Bank Verification Number (BVN) is required. A credit inflow to account in the first month of reactivation allows you to enjoy the benefits. Sign up for at least one (1) of the electronic banking channels.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in if fcmb is showing you that your profile is blocked does that means your atm card is blocked too without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your how to reactivate my dormant fcmb account online, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my how to unblock your fcmb account in Gmail?

Create your eSignature using pdfFiller and then eSign your how do i recover my 329 on your mobile phone immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit fcmb ussd code activation on an Android device?

You can edit, sign, and distribute code for fcmb ussd on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is FCMB Reactivation of Account Form (Corporate)?

The FCMB Reactivation of Account Form (Corporate) is a document used by businesses to reactivate their dormant or inactive accounts with FCMB (First City Monument Bank).

Who is required to file FCMB Reactivation of Account Form (Corporate)?

Any corporate entity with a dormant or inactive account at FCMB is required to file the FCMB Reactivation of Account Form (Corporate) to restore their banking services.

How to fill out FCMB Reactivation of Account Form (Corporate)?

To fill out the FCMB Reactivation of Account Form (Corporate), a representative of the corporate entity should provide the company's details, account number, reason for reactivation, and any supporting documents required by the bank.

What is the purpose of FCMB Reactivation of Account Form (Corporate)?

The purpose of the FCMB Reactivation of Account Form (Corporate) is to facilitate the reactivation process of dormant corporate accounts, allowing businesses to access their funds and banking services once again.

What information must be reported on FCMB Reactivation of Account Form (Corporate)?

The information required on the FCMB Reactivation of Account Form (Corporate) includes the corporate entity's name, registration details, account numbers, contact information, and the reason for the account's inactivity.

Fill out your FCMB Reactivation of Account Form Corporate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fcmb Transfer Code Nigeria is not the form you're looking for?Search for another form here.

Keywords relevant to the fcmb reactivation of account form is a crucial document and compliant with bank policies

Related to fcmb account number retrieval ussd code mobile app internet banking

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.